| 1 |

JUNG H, SONG S, AHN Y H, et al. Effects of emission trading schemes on corporate carbon productivity and implications for firm-level responses[J]. Scientific Reports, 2021, 11 (1): 11679.

DOI

|

| 2 |

郑国光. 支撑“双碳” 目标实现的问题辨识与关键举措研究[J]. 中国电力, 2023, 56 (11): 1- 8.

|

|

ZHENG Guoguang. Problem identification and key measures to support the achievement of carbon peak and carbon neutrality[J]. Electric Power, 2023, 56 (11): 1- 8.

|

| 3 |

袁家海, 张为荣, 沈啟霞, 等. 煤电完全市场化后的电碳市场耦合问题研究[J]. 中国国情国力, 2021, (12): 12- 20.

|

|

YUAN Jiahai, ZHANG Ronghui, SHEN Qixia, et al. Research on coupling problem of electric carbon market after full marketization of coal power[J]. China National Situation and Strength, 2021, (12): 12- 20.

|

| 4 |

陈杰. 碳市场对电力现货市场影响的模拟研究[D]. 北京: 华北电力大学, 2020.

|

|

CHEN Jie. Simulation study on the influence of carbon market on electricity spot market[D]. Beijing: North China Electric Power University, 2020.

|

| 5 |

冯升波, 黄建, 周伏秋, 等. 碳市场对可再生能源发电行业的影响[J]. 宏观经济管理, 2019, (11): 55- 62.

|

|

FENG Shengbo, HUANG Jian, ZHOU Fuqiu, et al. Influence of carbon market on renewable energy power generation industry[J]. Macroeconomic Management, 2019, (11): 55- 62.

|

| 6 |

吉斌, 孙绘, 梁肖, 等. 面向“双碳”目标的碳电市场融合交易探讨[J]. 华电技术, 2021, 43 (6): 33- 40.

|

|

JI Bin, SUN Hui, LIANG Xiao, et al. Discussion on convergent trading of the carbon and electricity market on the path to carbon peak and carbon neutrality[J]. Huadian Technology, 2021, 43 (6): 33- 40.

|

| 7 |

赵长红, 张明明, 吴建军, 等. 碳市场和电力市场耦合研究[J]. 中国环境管理, 2019, 11 (4): 105- 112.

|

|

ZHAO Changhong, ZHANG Mingming, WU Jianjun, et al. The coupling study on carbon market and power market[J]. Chinese Journal of Environmental Management, 2019, 11 (4): 105- 112.

|

| 8 |

冯昌森, 谢方锐, 文福拴, 等. 基于智能合约的绿证和碳联合交易市场的设计与实现[J]. 电力系统自动化, 2021, 45 (23): 1- 11.

|

|

FENG Changsen, XIE Fangrui, WEN Fushuan, et al. Design and implementation of joint trading market for green power certificate and carbon based on smart contract[J]. Automation Electric Power Systems, 2021, 45 (23): 1- 11.

|

| 9 |

马忠玉, 冶伟峰, 蔡松锋, 等. 基于SICGE模型的中国碳市场与电力市场协调发展研究[J]. 宏观经济研究, 2019, (5): 145- 153.

|

|

MA Zhongyu, YE Weifeng, CAI Songfeng, et al. A study on coordinated development of China's carbon market and power market based on SICGE model[J]. Macroeconomics, 2019, (5): 145- 153.

|

| 10 |

孙友源, 郭振, 张继广, 等. 碳市场与电力市场机制影响下发电机组成本分析与竞争力研究[J]. 气候变化研究进展, 2021, 17 (4): 476- 483.

|

|

SUN Youyuan, GUO Zhen, ZHANG Jiguang, et al. Research on cost analysis and competitiveness of power generation units under the influence of carbon market and power market coupling mechanism[J]. Climate Change Research, 2021, 17 (4): 476- 483.

|

| 11 |

WANG P, TANG J J, ZHANG Z, et al. Bidding strategy optimization for power generation company in carbon emission rights and electricity market[J]. Energy Reports, 2022, 8, 325- 331.

|

| 12 |

张刚, 张峰, 张利, 等. 考虑碳排放交易的日前调度双阶段鲁棒优化模型[J]. 中国电机工程学报, 2018, 38 (18): 5490- 5499.

|

|

ZHANG Gang, ZHANG Feng, ZHANG Li, et al. Two-stage robust optimization model of day-ahead scheduling considering carbon emissions trading[J]. Proceedings of the CSEE, 2018, 38 (18): 5490- 5499.

|

| 13 |

ZHANG X Y, GUO X P, ZHANG X P. Bidding modes for renewable energy considering electricity-carbon integrated market mechanism based on multi-agent hybrid game[J]. Energy, 2023, 263, 125616.

DOI

|

| 14 |

刘洋, 崔雪, 谢雄, 等. 电碳联动环境下考虑社会效益最优的发电权交易研究[J]. 电测与仪表, 2020, 57 (13): 112- 117, 148.

|

|

LIU Yang, CUI Xue, XIE Xiong, et al. Research on the trading of clean energy power generation right with the best social benefit under the electric-carbon linkage environment[J]. Electrical Measurement & Instrumentation, 2020, 57 (13): 112- 117, 148.

|

| 15 |

DING Tao, LU Runzhao, XU Yiting, et al. Joint electricity and carbon market for Northeast Asia energy interconnection[J]. Global Energy Interconnection, 2020, 3 (2): 99- 110.

|

| 16 |

ANDRIANESIS P, BISKAS P, LIBEROPOULOS G. Evaluating the cost of emissions in a pool-based electricity market[J]. Applied Energy, 2021, 298, 117253.

DOI

|

| 17 |

GUO B W, CASTAGNETO GISSEY G. Cost pass-through in the British wholesale electricity market[J]. Energy Economics, 2021, 102, 105497.

DOI

|

| 18 |

CLUDIUS J, DE BRUYN S, SCHUMACHER K, et al. Ex-post investigation of cost pass-through in the EU ETS - an analysis for six industry sectors[J]. Energy Economics, 2020, 91, 104883.

DOI

|

| 19 |

FATEMEH N, STEFAN T, ZHU L X. Carbon pass-through rates on spot electricity prices in Australia[J]. Energy Economics, 2021, 96, 105178.

DOI

|

| 20 |

YU S Y, CHEN Y K, PU L C, et al. The CO2 cost pass-through and environmental effectiveness in emission trading schemes[J]. Energy, 2022, 239, 122257.

DOI

|

| 21 |

陈志斌, 林立身. 全球碳市场建设历程回顾与展望[J]. 环境与可持续发展, 2021, 46 (3): 37- 44.

|

|

CHEN Zhibin, LIN Lishen. Review and prospect of carbon emission trading market in the world[J]. Environment and Sustainable Development, 2021, 46 (3): 37- 44.

|

| 22 |

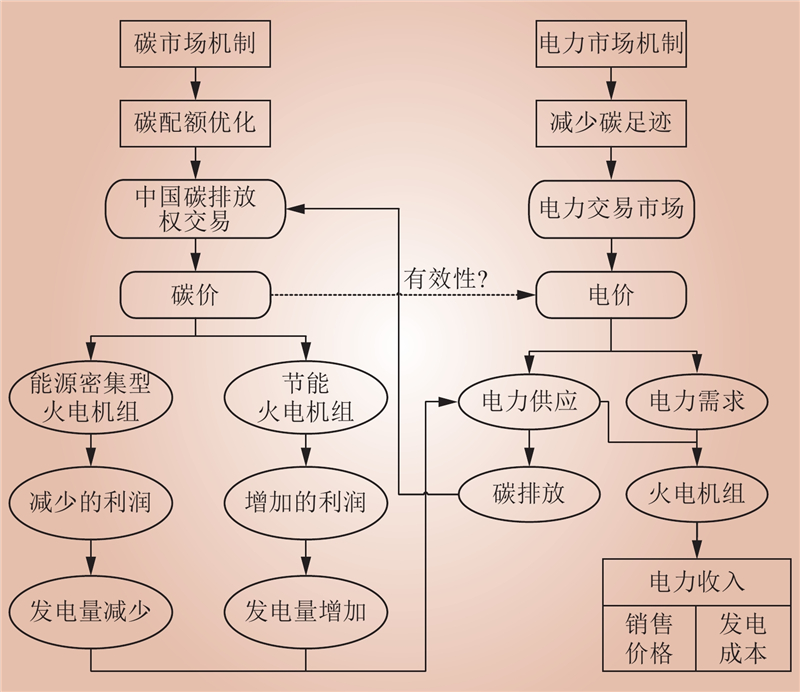

尚楠, 陈政, 卢治霖, 等. 电力市场、碳市场及绿证市场互动机理及协调机制[J]. 电网技术, 2023, 47 (1): 142- 154.

|

|

SHANG Nan, CHEN Zheng, LU Zhilin, et al. Interaction principle and cohesive mechanism between electricity market, carbon market and green power certificate market[J]. Power System Technology, 2023, 47 (1): 142- 154.

|

| 23 |

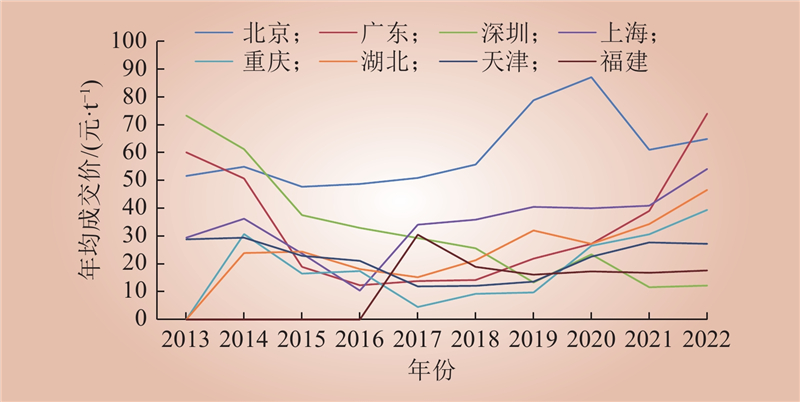

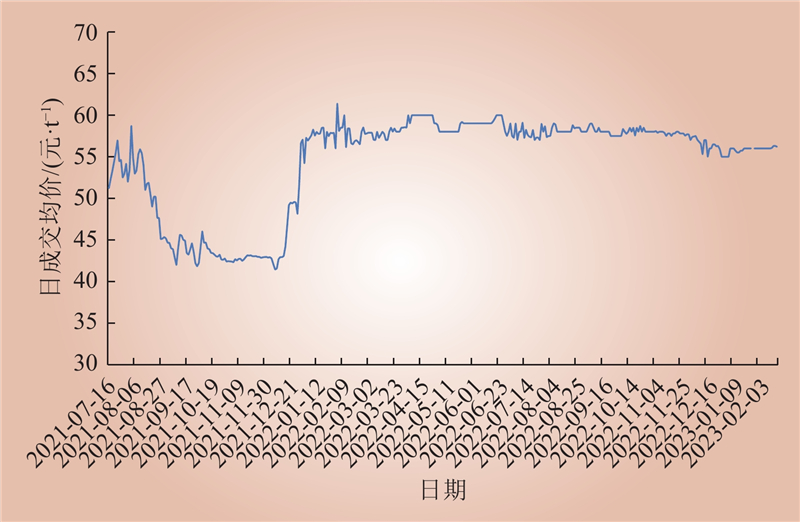

孙文娟, 张胜军, 孙海萍. 试点碳市场发展现状及对全国碳市场的启示[J]. 国际石油经济, 2021, 29 (7): 1- 8.

|

|

SUN Wenjuan, ZHANG Shengjun, SUN Haiping. Development status of pilot carbon markets and its enlightenments to national carbon market[J]. International Petroleum Economics, 2021, 29 (7): 1- 8.

|

| 24 |

郑爽, 刘海燕. 碳交易试点地区电力部门配额分配比较研究及对全国的借鉴[J]. 气候变化研究进展, 2020, 16 (6): 748- 757.

|

|

ZHENG Shuang, LIU Haiyan. Comparative study on power sector allowance allocation among China's Emissions Trading Scheme pilots and its implications for national carbon market[J]. Climate Change Research, 2020, 16 (6): 748- 757.

|

| 25 |

郭尊, 李庚银, 周明. 计及碳交易机制的电-气联合系统快速动态鲁棒优化运行[J]. 电网技术, 2020, 44 (4): 1220- 1228.

|

|

GUO Zun, LI Gengyin, ZHOU Ming. Fast and dynamic robust optimization of integrated electricity-gas system operation with carbon trading[J]. Power System Technology, 2020, 44 (4): 1220- 1228.

|

| 26 |

袁泉, 张蔷, 禤培正, 等. 南方(以广东起步)电力现货市场双边交易仿真分析研究[J]. 广东电力, 2022, 35 (6): 10- 17.

|

|

YUAN Quan, ZHANG Qiang, XUAN Peizheng, et al. Simulation analysis and research on bilateral trade in Southern China (starting from Guangdong Province) electric spot market[J]. Guangdong Electric Power, 2022, 35 (6): 10- 17.

|

| 27 |

郑鑫, 邱泽晶, 郭松, 等. 电动汽车V2G调度优化策略的多指标评估方法[J]. 新能源进展, 2022, 10 (5): 485- 494.

|

|

ZHENG Xin, QIU Zejing, GUO Song, et al. Multi-index evaluation method considering V2G scheduling optimization strategy of EV charging and discharging[J]. Advances in New and Renewable Energy, 2022, 10 (5): 485- 494.

|

| 28 |

朱国荣, 单钰淇, 劳咏昶, 等. 电力现货市场环境下的火电厂定价策略研究: 基于短期竞价博弈模型的分析[J]. 价格理论与实践, 2020, (6): 92- 96, 180.

|

|

ZHU Guorong, SHAN Yuqi, LAO Yongchang, et al. Research on the pricing strategy of thermal power plants in the electricity spot market——analysis based on short-term bidding game model[J]. Price: Theory & Practice, 2020, (6): 92- 96, 180.

|

| 29 |

艾昱. 中国上网电价机制改革研究[D]. 北京: 华北电力大学(北京), 2020.

|

|

AI Yu. Research on the reform of feed-in tariff mechanism in China [D]. Beijing: North China Electric Power University (Beijing), 2020.

|

| 30 |

聂佳鑫. 欧盟碳排放权交易发展对我国的启示[J]. 黑龙江金融, 2021, (9): 62- 64.

|

| 31 |

中国工商银行与北京环境交易所联合课题组. 碳交易对银行信用风险的压力测试[J]. 清华金融评论, 2020, (9): 36- 38.

|

| 32 |

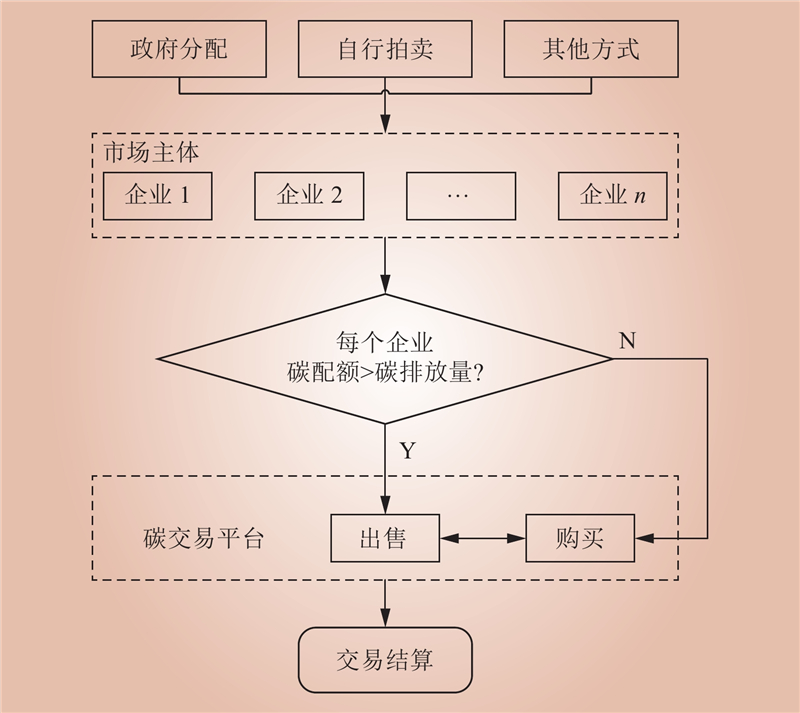

周小惠. 碳交易市场背景下区域碳排放权配额动态分配机制及方法研究[D]. 成都: 西华大学, 2022.

|

|

ZHOU Xiaohui. Research on the dynamic allocation mechanism and method of regional carbon emission rights quota under the background of carbon trading market[D]. Chengdu: Xihua University, 2022.

|